Sierra Club, Earthjustice File Legal Challenge to Protect Solar Tax Credit in Hawai‘i State tax proposal would slam the brakes on solar energy, Hawai‘i jobs

Today, the Sierra Club, represented by Earthjustice, filed a legal challenge in state circuit court to the Hawai‘i Department of Taxation’s recent decision to cut back on tax credits for residents and businesses that install solar energy systems. The Department’s new interpretation of the solar credit – which was announced November 9, 2012 and goes into effect January 1, 2013 – will drastically reduce the availability of the Hawai‘i renewable energy tax credit for solar photovoltaic systems and threatens Hawai‘i’s progress in promoting renewable energy and in weaning itself off fossil fuels.

Sierra Club Hawai‘i Chapter Director Robert D. Harris said, “Since the Department announced it was cutting support for solar energy systems, we’ve heard from hundreds of our members across the state who say they will no longer be able to afford to install solar panels on their roofs. We’ve also heard of investors pulling out of several large-scale commercial projects because the reduced credit makes the projects unviable. This goes completely against what the legislature tried to accomplish in enacting and expanding the solar tax credit.”

The legal challenge says the department’s new rule conflicts with the law’s aim of encouraging widespread adoption of residential and commercial solar energy systems, which are vital for Hawai‘i to reach its goal of 40 percent of its energy coming from locally generated, renewable sources by 2030.

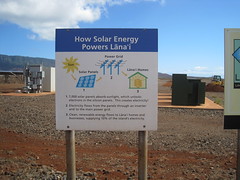

Hawai‘i has a strong reason to encourage a shift to renewable energy, especially rooftop solar energy systems. Historically, Hawai‘i has relied on power from imported oil and coal for nearly all of its energy needs, at great expense to homeowners and businesses alike. Bathed in sun year round, Hawai‘i is well positioned to being the first state to shed its dependence on dirty, increasingly expensive fossil fuels.

“The administration is wrongly slamming the brakes on one of the few success stories in achieving Hawai‘i’s clean energy goals,” said Harris.

The Department’s new interpretation would slash the average tax credit to homeowners and businesses that install

solar energy systems by about half. It also threatens the future of thousands of solar energy workers in one of Hawai‘i’s strongest growth sectors.

“By suddenly and dramatically clamping down on the solar tax credit, the department is damaging a major engine of economic growth,” said economist Thomas Loudat. “The solar industry accounts for over 15 percent of all construction expenditures in the state. When those companies start going belly up because folks can’t afford to install solar systems, we’re going to have a lot of unemployed workers, which is going to impose huge costs on Hawai‘i’s taxpayers.”

“Thousands of jobs like mine are at stake,” said Steve Mazur, a solar energy employee and Sierra Club member. “We don’t want to see companies destroyed and livelihoods threatened because Governor Abercrombie simply wasn’t willing to discuss a rational updating of the tax code.”

Among the hardest hit from the rule change are lower-income groups, including many local households that cannot afford to install solar systems without an adequate credit.

“We’ve just gotten to the point where the cost has come down enough for the less well-off to be able to afford or lease solar panels,” said economist Loudat. “By dramatically cutting the tax credit, the Department of Taxation is jacking the price back up, so that the average Hawai‘i resident is less likely to enjoy the benefits of solar. Those least able to afford it are going to be forced to pay for electricity generated from increasingly expensive fossil fuels.”

The department changed its interpretation of the solar credit after asking the state legislature to pass a similar reduction to the credit last session, which the legislature refused to do.

“In our democracy, the legislature makes clean energy policy, not the Department of Taxation,” Earthjustice attorney David Henkin said. “If the department thinks the solar credit law should be changed, it can go to the legislature and make its case, like everyone else. Until then, its job is to implement the law, not unilaterally – and illegally – change it.”

Related articles